Markets Climb on Fed Expectations and Earnings Growth

The stock market climbed to new all-time highs in August, while bonds also contributed positively to portfolios. This occurred despite continued uncertainty around tariffs, Fed independence, and technology stocks. The month began with U.S. tariffs going into effect against most major trading partners after the initial 90-day pause. A federal appeals court later ruled that the “reciprocal tariffs” are illegal, possibly paving the way for the case to reach the Supreme Court.

Markets also stumbled mid-month due to concerns that the Fed could keep rates higher for longer to fight inflation. Recent inflation reports, such as the Producer Price Index, suggest that companies are beginning to pass tariff costs through to consumers. However, market sentiment quickly rebounded due to better-than-expected corporate earnings and greater confidence that the Fed will cut policy rates at its upcoming September meeting.

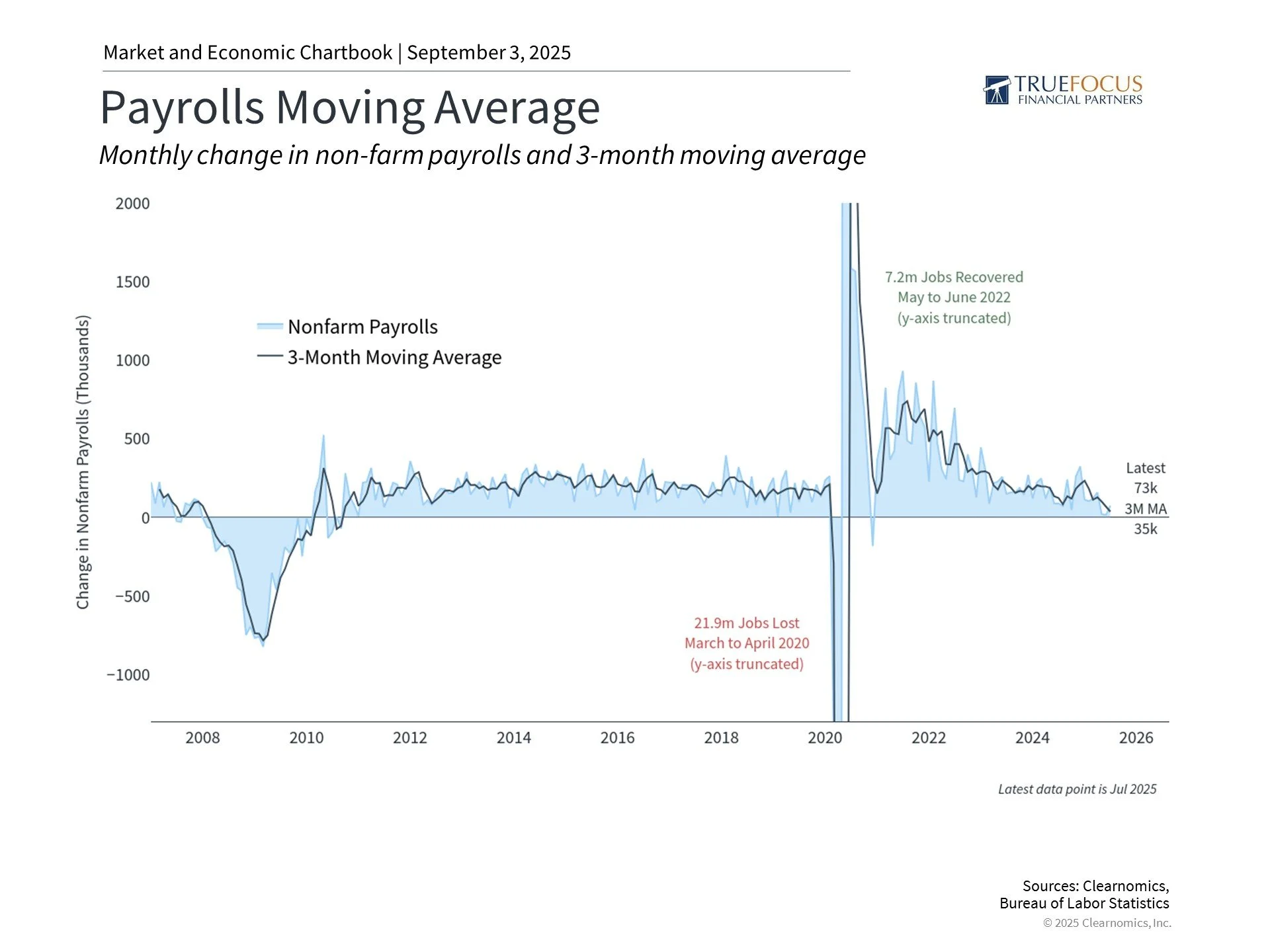

Economic figures were mixed. GDP growth for the second quarter was revised higher from 3.0% to 3.3%, a strong improvement from the first quarter's 0.5% decline. However, the jobs report published at the start of the month showed a significant decline in new payrolls, including large downward revisions to prior months. This led the White House to fire the Commissioner of the Bureau of Labor Statistics, adding to the uncertain environment.

Despite these challenges, market volatility remains low by historical standards. August's solid performance across stocks and bonds underscores the importance for investors to stay balanced and focused on the long run.

Key Market and Economic Drivers

The S&P 500 rose 1.9% in August, the Dow Jones Industrial Average 3.2%, and the Nasdaq 1.6%. Year-to-date, the S&P 500 is up 9.8%, the Dow is up 7.1%, and the Nasdaq is up 11.1%.

The Bloomberg U.S. Aggregate Bond Index gained 1.2% in August. The 10-year Treasury yield ended the month lower at 4.2%.

International developed markets jumped 4.1% in U.S. dollar terms using the MSCI EAFE index, while emerging markets gained 1.2% based on the MSCI EM index. Year-to-date, the MSCI EAFE index has gained 20.4% and the MSCI EM index 17.0%.

The U.S. dollar index ended the month lower at 97.8.

Bitcoin fell in August, ending the month at 109,127 after experiencing a “flash crash” on August 24.

Gold prices ended the month at a new all-time high of $3,487.

The Consumer Price Index rose 2.7% on a year-over-year basis in July, in line with economist expectations.

The jobs report showed that the economy added only 73,000 jobs in July. Significant downward revisions to the May and June figures mean that the labor market was much weaker than originally reported. The unemployment rate remained low at 4.2%.

While day-to-day news and headlines can drive markets in the short run, fundamentals like earnings and valuations are what affect portfolio returns in the long run. Although stock market valuations are quite high by historical standards, this is supported by corporations that continue to grow earnings at a healthy pace.

The latest earnings season numbers show that 81% of S&P 500 companies have beaten estimates, according to FactSet. This is the highest percentage since the third quarter of 2023, demonstrating that the economy and corporate fundamentals have been stronger than many expected.(1) This also underscores the adaptability of companies as they adjust to tariffs, absorb higher costs, and find ways to grow despite policy uncertainty.

Many investors are focused on the earnings and returns of the Magnificent 7, a group of mega-cap companies, including some with multi-trillion-dollar market capitalizations. This group now represents over one-third of the S&P 500, so their performance can have a major impact on the broader market. The earnings results were mixed for this group overall, but some of these “hyperscalers” did exceed expectations. Despite concerns about an “AI bubble,” these results helped to drive a market rally in the second half of August.

The Fed is expected to cut rates

In contrast, consumer-facing businesses reported mixed results due to changing household spending patterns. This is exacerbated by the implementation of tariffs, as companies pass on a greater proportion of tariff costs to consumers. Combined with the weaker-than-expected jobs data, markets began anticipating greater rate cuts beginning in September.

Fed Chair Jerome Powell, in a speech at their annual conference in Jackson Hole, Wyoming, provided the clearest signal yet that the central bank is prepared to resume cutting interest rates after pausing this year. The Fed has a “dual mandate” to keep inflation steady and unemployment low. Recently, they have kept interest rates relatively high due to stubborn inflation and a strong job market. Thus, early signs of job market softness could tip the Fed’s decision-making toward careful rate cuts.

Fed rate cuts can create opportunities across asset classes

The prospect of additional Fed rate cuts could create opportunities across asset classes. In addition to supporting broad economic growth, lower interest rates can improve borrowing costs for companies, reduce hurdles for new projects, and increase the present value of future cash flows. For bonds, lower interest rates boost the prices of existing bonds that were issued at higher yields.

Bond yields have hovered in a narrow range this year, with the 10-year Treasury yield generally fluctuating between 4.0% and 4.5%. Even if short-term yields decline as the Fed cuts rates, many bond sectors are providing healthy levels of income. The U.S. aggregate bond index is yielding 4.4%, investment-grade corporate bonds 4.9%, and high-yield bonds 6.7%. These levels are well above historical averages and support balanced portfolios.

For overall portfolios, investors should continue to focus on managing the different risk and return drivers. Topics such as tariffs, Fed policy, and the risk of a government shutdown in Washington are only some of the issues that investors will face in the months ahead. Rather than reacting to each event, holding a portfolio that can withstand these swings, while providing both income and long-term growth, is the best way to achieve financial goals.

The bottom line? Markets reached new all-time highs in August despite many policy concerns. Healthy earnings and economic growth continue to support portfolios despite ongoing uncertainty.

1.https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_082925.pdf